Our Commitment to ESG

At IPR.VC, we believe that strong environmental, social, and governance (ESG) principles are not just good business. They are essential for shaping a sustainable and inclusive future. Our approach combines clear targets, measurable results, and practical tools for our partners.

We manage an SFDR Article 8 fund (Fund III) and operate under the Finnish AIFM regulation. IPR.VC is a full member of FVCA (Finnish Venture Capital Association), a member of Finsif (Finland’s Sustainable Investment Forum) and a full member of Invest Europe.

We focus our ESG efforts on two United Nations Sustainable Development Goals:

- Gender Equality (SDG 5)

- Climate Action (SDG 13)

These priorities guide our investment decisions for productions financed through Fund III, as well as our own daily operations. We report annually on progress toward these goals.

Promoting Gender Equality

in films financed by Fund III we have set measurable targets for the share of women in key creative roles: writers, directors, and lead cast.

While we respect the artistic vision of each production, we are committed to ensuring that both women and men are represented in meaningful ways on and off screen.

Tackling Climate Change

As a venture capital company, our own greenhouse gas (GHG) emissions are relatively modest. However, we fully recognize the urgency of climate change and our responsibility to act. The greatest opportunity for impact lies in the productions we finance.

Our requirements for Fund III–financed productions:

Before production: A carbon footprint reduction plan must be in place.

After production: A carbon footprint calculation must be completed.

We also encourage productions to consider biodiversity impacts alongside emissions reduction.

We provide templates and guidance to make sustainability reporting simple for our partners, even if detailed data is not yet available.

Our ESG policy is overseen by a dedicated board member. All partners must commit to sustainability requirements as part of our due diligence.

Achieve gender equality and empower all women and girls

- Our target is to promote Gender Equality in production benefiting from Fund III financing

- We collect data of the number of female writers, directors and key actors

- KPIs: aiming at female share

- Writers at least 20%

- Directors at least 30%

- Lead cast at least 40%

Take urgent action to combat climate change and its impacts

- Our target is to drive measurable carbon reduction actions across productions

- KPIs: We expect all productions benefiting from IPR.VC Financing

- to make a carbon footprint reduction plan

- to calculate CO2 of the production

Reducing Our Own Footprint

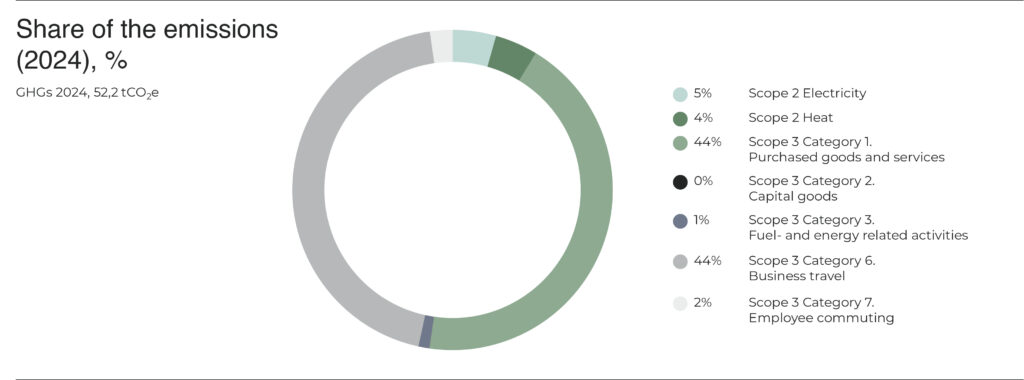

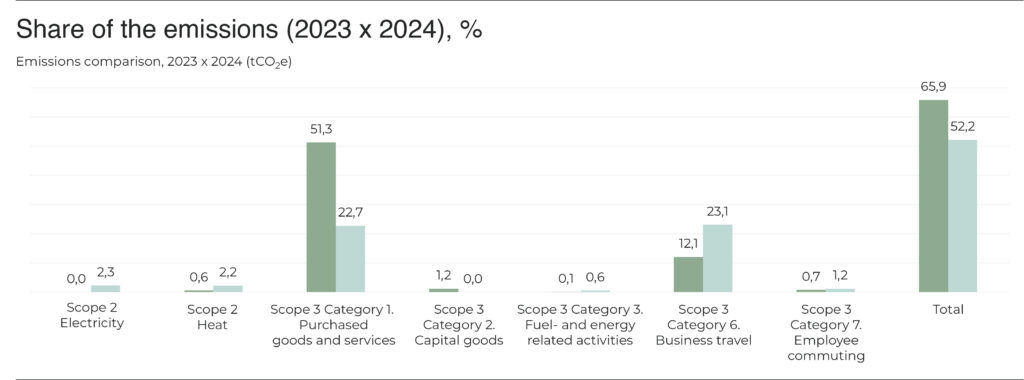

IPR.VC Management, share of the emissions (2024), %

We are taking steps to reduce both direct and indirect emissions across our offices:

Sustainable Catering & Hospitality

- Prioritizing seasonal, locally sourced, plant-based foods at all events

- Minimizing food waste through careful planning

- Using reusable or compostable tableware and avoiding single-use plastics

Low-Carbon Travel Policy

- Choosing train travel over short-haul flights (under 500 km)

- Flying economy class when possible

- Making video conferencing the default for international meetings

Employee Engagement

- Incentivizing public transport for commuting

- Providing climate-awareness training for all team members

To follow up the development, we do annually a GHG calculation of our own operations and take actions to minimize emissions.

By embedding these commitments into our operations and investment process, we aim to help build a more equitable industry and a healthier planet.

Form for the periodic disclosures of financial products referred to in Article 8(1), (2) and (2a) of Regulation (EU) 2019/2088 and in the first paragraph of Article 6 of Regulation (EU) 2020/852

The following Financial Supervisory Authority regulation material is in Finnish language.

Lomake asetuksen (EU) 2019/2088 8 artiklan 1, 2 ja 2 a kohdassa ja asetuksen (EU) 2020/852 6 artiklan ensimmäisessä kohdassa tarkoitetuista rahoitustuotteista määräajoin annettaville tiedoille

Tuotenimi: IPR.VC Fund III Ky

Oikeushenkilötunnus: 3375795-8

Ympäristöön ja/tai yhteiskuntaan liittyvät ominaisuudet

Missä määrin tämän rahoitustuotteenedistämät ympäristöön ja/tai yhteiskuntaan liittyvät ominaisuudet ovat toteutuneet?

Miten kestävyysindikaattorit ovat suoriutuneet? Kuluneelta tilikaudelta ei ole vielä käytössä toteutuneita hiilijalanjälkilaskelmia. Sukupuolten välistä tasa-arvoa koskeneet tavoitteet ovat toteutuneet seuraavasti:

..entä verrattuna edellisiin kausiin? Edelliseltä kaudelta ei ole toteutuneita arvoja, koska ensimmäiset sijoitukset tehtiin vuonna 2024.

Mitkä ovat olleet niiden kestävien sijoitusten tavoitteet, jotka rahoitustuotteessa on tehty osittain, ja miten kestävä sijoitus on edistänyt näiden tavoitteiden saavuttamista? Kestäviä sijoituksia ei ole tehty

Miten rahoitustuotteessa osittain tehdyt kestävät sijoitukset eivät ole aiheuttaneet merkittävää haittaa yhdellekään ympäristön tai yhteiskunnan kannalta kestävälle sijoitustavoitteelle? n/a

Miten tässä rahoitustuotteessa on otettu huomioon pääasialliset haitalliset vaikutukset kestävyystekijöihin? n/a

Mitkä ovat olleet tämän rahoitustuotteen merkittävimmät sijoitukset?

| Suurimmat sijoitukset | Ala | % varoista | Maa |

|---|---|---|---|

| A24 Distribution LLC | Elokuvatuotanto | 65% | USA |

| 2639 Media Capital LLC | Elokuvatuotanto | 35% | USA |

Mikä on ollut kestävyyteen liittyvien sijoitusten osuus?

Mikä on ollut varojen allokointi? Kestävyyteen liittyviä sijoituksia ei ole tehty.

Millä talouden aloilla sijoituksia on tehty? Elokuvatuotanto ja -levitys

Missä määrin kestävät sijoitukset, joilla on ympäristötavoite, ovat olleet EU:n luokitusjärjestelmän mukaisia? n/a

Rahasto ei noudata EU:n luokitusjärjestelmää.

Mikä on ollut siirtymätoimintoihin ja mahdollistaviin toimintoihin tehtyjen sijoitusten osuus? 0%

Millainen EU:n luokitusjärjestelmän mukaisten sijoitusten prosenttiosuus on verrattuna aiempiin viitekausiin? n/a

Mikä on sellaisten kestävien sijoitusten osuus, joilla on ympäristötavoite ja jotka eivät ole EU:n luokitusjärjestelmän mukaisia?n/a

Mikä on ollut yhteiskunnan kannalta kestävien sijoitusten osuus? n/a

Mitkä sijoitukset ovat sisältyneet kohtaan “Muu”, mikä on ollut niiden tarkoitus ja onko

sovellettu ympäristöön liittyviä tai yhteiskunnallisia vähimmäistason suojatoimia?

Mitä toimia on toteutettu ympäristöön tai yhteiskuntaan liittyvien ominaisuuksien toteutumiseksi viitekaudella? Filmien tuottajien kanssa on keskusteltu toimenpiteistä tasa-arvon edistämiseksi. Ns. Preproduction vaiheessa tuotantotiimille tarjotaan käyttöön ympäristökonsultti ja tuotantojen edellytetään tekevän suunnitelma hiilijalanjäljen alenteamiseksi. Tuotantovaiheen päätyttyä elokuvan tai TV-sarjan hiilijalanjälki lasketaan ja verrataan toimenpiteitä tehtyyn suunnitelmaan.

Miten tämä rahoitustuote on suoriutunut verrattuna vertailuarvoon? Rahoitustuotteella ei ole vertailuarvoa

Miten vertailuarvo poikkeaa yleisestä markkinaindeksistä? n/a

Miten tämä rahoitustuote on suoriutunut suhteessa kestävyysindikaattoreihin, joiden tarkoituksena on määrittää, vastaako vertailuarvo edistettäviä ympäristöön tai yhteiskuntaan liittyviä ominaisuuksia? n/a

Miten tämä rahoitustuote on suoriutunut verrattuna vertailuarvoon? n/a

Miten tämä rahoitustuote on suoriutunut verrattuna yleiseen markkinaindeksiin? n/a